UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Filed by the Registrant xþ

Filed by a Party other than the Registrant o

Check the appropriate box:

| o | Preliminary Proxy Statement |

| o | Confidential, |

þ | Definitive Proxy Statement |

o | Definitive Additional Materials |

| o | Soliciting Material |

MILLER INDUSTRIES, INC. | |||

| (Name of Registrant as Specified | |||

(Name of Person(s) Filing Proxy Statement, if | |||

| Payment of Filing Fee (Check the appropriate box): | |||

| þ | No fee required. | ||

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | ||

| (1) | Title of each class of securities to which transaction applies: | ||

| (2) | Aggregate number of securities to which transaction applies: | ||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | ||

| (4) | Proposed maximum aggregate value of transaction: | ||

| (5) | Total fee paid: | ||

| o | Fee paid previously with preliminary materials. | ||

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | ||

| (1) | Amount Previously Paid: | ||

| (2) | Form, Schedule or Registration Statement No.: | ||

| (3) | Filing Party: | ||

| (4) | Date Filed: | ||

8503 Hilltop Drive

Ooltewah, Tennessee 37363

(423) 238-4171

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS TO BE HELD MAY 22, 2009 |

The annual meeting of shareholders of Miller Industries, Inc. will be held at 9:00 a.m. (Eastern Time)time), on Friday, May 26, 2006,22, 2009, at 1100 Peachtree Street, Suite 2800, Atlanta, Georgia, for the following purposes:

| 1. | to elect five |

| 2. | to transact such other business as may properly come before the meeting or any adjournment thereof. |

Only shareholders of record at the close of business on April 13, 20067, 2009 are entitled to notice of and to vote at the annual meeting. Your attention is directed to the proxy statement accompanying this notice for a complete statement regarding matters to be acted upon at the annual meeting.

By order of the Board of Directors, | ||

| /s/ Frank Madonia | ||

| Frank Madonia | ||

| Secretary |

April 21, 200615, 2009

We urge you to attend the |

TABLE OF CONTENTS

Page

GENERAL | 1 | |

| VOTING PROCEDURES | 1 | |

| NOTICE REGARDING THE AVAILABILITY OF | 2 | |

| PROPOSAL 1 — ELECTION OF DIRECTORS | 2 | |

| Introduction | 2 | |

| Information Regarding Nominees | 3 | |

| CORPORATE GOVERNANCE | 4 | |

| Independence, Board Meetings and Related Information | ||

| Committees of the Board of Directors | 4 | |

| Director Nominations | ||

| 5 | ||

| Related Transactions and Business Relationships | 5 | |

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 6 | |

| COMPENSATION OF EXECUTIVE OFFICERS AND DIRECTORS | 7 | |

| Compensation | ||

| 10 | ||

Compensation Committee Interlocks and Insider Participation | 10 | |

| Summary Compensation | 10 | |

| Grants of Plan-Based Awards Table | 11 | |

| Additional Discussion of Material Items in Summary Compensation Table | 11 | |

| Outstanding Equity Awards at Fiscal Year-End 2008 | 12 | |

| Option Exercises and Stock Vested in 2008 | 12 | |

| Potential Payments Upon Termination or Change in Control | 12 | |

| Non-Employee Director Compensation for 2008 | 16 | |

| ACCOUNTING MATTERS | 16 | |

| Audit Committee Report | 16 | |

| Independent Public Accountants | 17 | |

| CODE OF BUSINESS CONDUCT AND ETHICS | ||

| EQUITY COMPENSATION PLAN INFORMATION | ||

| COMPLIANCE WITH SECTION 16(a) OF THE SECURITIES EXCHANGE ACT OF 1934 | ||

OTHER MATTERS | ||

| Deadline for Shareholder Proposals for | ||

| Expenses of Solicitation | ||

MILLER INDUSTRIES, INC.

8503 Hilltop Drive

Ooltewah, Tennessee 37363

(423) 238-4171

PROXY STATEMENT FOR

ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD MAY 26, 200622, 2009

GENERAL

This proxy statement is being furnished in connection with the solicitation of proxies by the Board of Directors of Miller Industries, Inc. (the “Company” or “Miller Industries”) for use at the Company’s 2009 annual meeting of shareholders (the “Annual Meeting”) to be held at 1100 Peachtree Street, Suite 2800, Atlanta, Georgia, on Friday, May 26, 2006,22, 2009, at 9:00 a.m. (Eastern Time)time), and any adjournments or postponements thereof. ThisIt is anticipated that this proxy statement and the accompanying proxy card werewill first be mailed to shareholders on or about April 26, 2006.17, 2009.

Only holders of the Company’s common stock, $0.01 par value per share (the “Common Stock”), at the close of business on April 13, 20067, 2009 are entitled to notice of and to vote at the Annual Meeting. On such date, the Company had issued and outstanding 11,347,63611,608,360 shares of Common Stock. A list of all shareholders entitled to vote will be available for inspection at the Annual Meeting.

VOTING PROCEDURES

A majority of shares entitled to vote and represented in person or by proxy at the Annual Meeting will constitute a quorum. Abstentions and “non-votes”broker non-votes will be counted for the purposespurpose of determining a quorum. Each outstanding share of Common Stock is entitled to one vote.

The election of the nomineesa nominee to the Board of Directors requires a plurality of the votes cast by holders of shares of Common Stock present in person or represented by proxy at the Annual Meeting. Therefore, those nominees receiving the greatest number of votes at the Annual Meeting shall be deemed elected, even though such nominees may not receive a majority of the votes cast.

Abstentions and broker non-votes will not be considered in the election of the nominees to the Board of Directors, but will be treated as votes against any other proposals presented to the shareholders. A “non-vote”broker non-vote occurs when a proxy received from a broker or other nominee holding shares foron behalf of a beneficial owner votes on one proposal, butclient does not votecontain voting instructions on another proposala “non-routine” matter because the broker or nominee doeshas not received specific voting instructions from the client with respect to such non-routine matter. Typically, the election of directors is considered a routine matter by brokers and other nominees allowing them to have discretionary voting power and has not received instructions from the beneficial owner.to vote shares they hold on behalf of their clients.

If you hold shares of Common Stock through a broker or other nominee (i.e., in “street name”), the broker or nominee should provide instructions on how you may instruct the broker or other nominee to vote those shares on your behalf.

1

A shareholder of record who votes over the Internet or by telephone may revoke the proxy by: (i) attending the Annual Meeting, notifying the Secretary of the Company (or his delegate), and voting in person; or (ii) voting again over the Internet or by telephone by no later than 1:00 a.m. (Central time) on May 22, 2009. A shareholder of record who signs and returns a proxy may revoke thesuch shareholder’s proxy at any time before it has been exercised by: (i) attending the Annual Meeting, notifying the Secretary of the Company (or his delegate), and voting in person,person; (ii) filing with the Secretary of the Company a written revocation,revocation; or (iii) duly executing and delivering a timely and valid proxy bearing a later date. Unless revoked, where a choice is specified on the proxy, the shares represented thereby will be voted in accordance with such direction.choice. If no specificationchoice is made,specified, such shares will be voted FORFOR the election of each of the five director nominees, and in the discretion of the proxy holders on any other matter that may properly come before the meeting. If you hold shares of Common Stock in street name you must follow the instructions given by your broker or nominee to change your voting instructions.

The Board of Directors has designated William G. Miller and Frank Madonia, and each or either of them, to vote on its behalf the proxies being solicited hereby. The Board of Directors knows of no matters which are to be brought to a vote at the Annual Meeting other than those set forth in the accompanying Notice of Annual Meeting. However, if any other matter properly does come before the Annual Meeting, the persons appointed in the proxy, or their substitutes, will vote in accordance with their best judgment on such matters.

NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS

The Company posted materials related to the Annual Meeting on the Internet. The following materials are available on the Internet at www.shareholdermaterial.com/MillerIndustries:

| ● | this proxy statement for the Annual Meeting; and | |

| ● | the Company’s 2009 Annual Report to Shareholders (which includes the Company’s Annual Report on Form 10-K for the year ended December 31, 2008, other than the exhibits thereto). |

PROPOSAL 1

ELECTION OF DIRECTORS

Introduction

Pursuant to the Company’s Charter and Bylaws, the Board of Directors has fixed the number of directors at five. The members of the Board of Directors comprise a single class, and at each annual meeting of shareholders all directors will beare elected. The directors elected at the Annual Meeting will serve until the annual meeting of shareholders in 2007,2010, or until their successors are duly elected and qualified. The Board of Directors may fill directorships resulting from vacancies, and may increase or decrease the number of directors to as many as fifteen or as few as three. Executive officers are appointed annually and serve at the discretion of the Board of Directors.

Upon the recommendation of the Nominating Committee, the Board of Directors has nominated Jeffrey I. Badgley, A. Russell Chandler, III, Paul E. Drack, William G. Miller and Richard H. Roberts, the current members of the Board, for re-election as directors. Each such nominee has consented to be named herein and to serve as a director, if elected.

Unless contrary instructions are received, shares of Common Stock represented by duly executed proxies will be voted in favor of the election of each of the five nominees named above to constitute the entire Board of Directors. The Board of Directors has no reason to expect that the nomineesany nominee will be unable to serve and, therefore, at this time it does not have any substitute nominees under consideration.

2

Directors are elected by a plurality of the votes cast by holders of the shares of Common Stock entitled to vote at the Annual Meeting. Shareholders have no right to vote cumulatively for directors. Each shareholder shall have one vote for each director for each share of Common Stock held by such shareholder.

Information concerning the nominees for election, based on data furnished by them, is set forth below. TheyCurrently, they are all now directors of the Company. The Board of Directors has determined that three of the five nomineesMessrs. Chandler, Drack and Roberts are independent directors under the listing standards of the New York Stock Exchange (“NYSE”).

THE BOARD UNANIMOUSLY RECOMMENDS THAT THE SHAREHOLDERS VOTE “FOR” THE ELECTION OF EACH OF THE FIVE DIRECTOR NOMINEES.

Information Regarding Nominees

Name of Director | Background Information | |

| Jeffrey I. Badgley | Mr. Badgley, |

A. Russell Chandler, III | Mr. Chandler, | |

| Paul E. Drack | Mr. Drack, |

3

Name of Director | Background Information | |

| William G. Miller | Mr. Miller, | |

| Richard H. Roberts | Mr. Roberts, |

CORPORATE GOVERNANCE

Independence, Board Meetings and Related Information

Independence

The Board of Directors has determined that a majority of the members of the Board of Directors are “independent”,“independent,” as “independent” is defined under applicable federal securities laws and the listing standards of the NYSE. The “independent”independent directors are Messrs. Chandler, Drack and Roberts.

Meetings

The Board of Directors held sevensix meetings during 2005.2008. All incumbent directors attended more than 75% of the meetings of the Board of Directors and the respective committees of which they are members. The non-management directors meet in executive session as a part of the meetings of the Audit Committee. The presiding director at those sessions is selected by the non-management directors on a meeting by meetingmeeting-by-meeting basis. The Company does not require its directors to attend its annual meeting of shareholders. In 2005,2008, two of the Company’s five directors attended the annual meeting of shareholders.shareholders in person, and the remaining three directors participated in the annual meeting by telephone.

Communication with Directors

Interested parties may communicate with aany non-management director by mailing a communication to the attention of that director at 8503 Hilltop Road,Drive, Ooltewah, Tennessee 37363.

Committees of the Board of Directors

The Board of Directors has standing Audit, Compensation and Nominating Committees. MembersGenerally, members of these committees are generally elected annually by the Board of Directors, but changes to the committees may be made at the Board of Directors’ discretion at any time. These committees operate pursuant to separate written charters adopted by the Board of Directors. These charters, along with the Company’s Corporate Governance Guidelines, are available on the Company’s website at www.millerind.com through the “Investor Relations” link. CopiesIn addition, copies of these charters and guidelines can also be obtained upon request from the Company’s Corporate Secretary.

4

Audit Committee

The Audit Committee is comprised of Messrs. Chandler, Drack and Roberts. The Board of Directors has determined that each of the members of the audit committee is “financially literate” within the meaning of the listing standards of the NYSE, and qualifies as an “audit committee financial expert” as defined by applicable SEC rules.

The Audit Committee, among other things, recommends the appointment of the Company’s independent public accountants, reviews the scope of audits proposed by the Company’s independent public accountants, reviews audit reports on various aspects of corporate operations, and periodically consults with the Company’s independent public accountants on matters relating to internal financial controls and procedures, among other duties.procedures. The Audit Committee held sixfour meetings during 2005.2008. The report of the Audit Committee is included in this proxy statement beginning on page 11.16.

Compensation Committee

The Compensation Committee is comprised of Messrs. Chandler, Drack and Roberts. The Compensation Committee establishes, among other things, salaries, bonuses and other compensation for the Company’s officers, and administers the Company’s stock option and other employee benefit plans. The Compensation Committee held one meetingthree meetings during 2005.2008. The report of the Compensation Committee is included in this proxy statement beginning on page 10.

Nominating Committee

The Nominating Committee is comprised of Messrs. Chandler, Drack and Miller.Roberts. The Nominating Committee was established to evaluate candidates for service as directors toof the Company and to conduct the Board’s annual self-assessment process. The Nominating Committee will consider candidates recommended by shareholders. Shareholder recommendations must comply with the procedures for director nominations set forth in Article I, Section 1.2, of the Company’s Bylaws.Bylaws and applicable law. The Nominating Committee held one meetingtwo meetings during 2005.2008.

Director Nominations

The Nominating Committee considers qualifications and characteristics that it, from time to time, deems appropriate when it selects individuals to be nominated for election to the Board of Directors. These qualifications and characteristics may include, without limitation, independence, integrity, business experience, education, accounting and financial expertise, age, diversity, reputation, civic and community relationships and industry knowledge and experience. In addition, prior to nominating an existing director for re-election to the Board of Directors, the Nominating Committee will consider and review anthe existing director’s Board and committee attendance, performance and length of Board service.

The Company recognizes that transactions between the Company entered intoor its subsidiaries and any of its directors or executive officers can present potential or actual conflicts of interest. Accordingly, as a Senior Credit Agreement with Wachovia Bank, National Association, for a new senior credit facility. Proceeds from this new senior credit facility were used to repay the lenders undergeneral matter it is the Company’s former senior credit facility, CIT Group/Business Credit, Inc. and William G. Miller,preference to avoid such transactions. Nevertheless, the Company recognizes that there are circumstances where such transactions may be in, or not inconsistent with, the best interests of the Company. Therefore, the Company has adopted a formal policy that requires the Company’s Chairman ofAudit Committee to review and, if appropriate, approve or ratify any such transactions. Pursuant to the Boardpolicy, the Committee will review any transaction in which the Company is or will be a participant and Co-Chief Executive Officer. In the transaction, CIT received $14.1 millionamount involved exceeds $120,000, and Mr. Miller received $12.0 million. As a result, effective June 17, 2005, the Company’s former senior credit facility was satisfied and terminated, and Mr. Miller ceased to holdin which any of the Company’s senior debt. This transaction was approved by the Company’s Audit Committee, as well as the full Board of Directors with Mr. Miller abstaining due to his personal interest in the transaction. The Company paid Mr. Miller approximately $664,000 in interest expense related to his portion of the former senior credit facility during 2005.

5

Certain Related Transactions and Business Relationships

In 2005,2008, the son of William G. Miller, the Company’s Chairman of the Board and Co-Chief Executive Officer and holder of approximately 4.13% of the Company’s Common Stock, was employed by a subsidiary of the Company as a salespersonVice President of Strategic Planning and Business Development and received a salary and bonus payments of approximately $60,650 and sales commissions of approximately $139,000, which were based on the Company’s commission structure that is applicable to all its salespersons.$128,150.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth, as of March 31, 2006,2009, certain information with respect to: (a) all shareholders known to be “beneficial owners” (as that term is defined in the rules of the Securities and Exchange Commission) of more than 5% of the Common Stock; and (b) the Common Stock “beneficially owned”beneficially owned by (i) by each director or nominee for director, (ii) by the executive officers named in the Summary Compensation Table, and (iii) by all executive officers and directors of the Company as a group.group, and (iv) all shareholders known to be beneficial owners (as that term is defined under SEC rules) of more than 5% of the Common Stock. Except as otherwise indicated, the shareholders listed in the table have sole voting and investment powers with respect to the Common Stock owned by them.

Name and Address of Beneficial Owner | Amount and Nature of Beneficial Ownership(1) | Percent of Class(2) | ||||||||

William G. Miller 5025 Harrington Road Alpharetta, GA 30022 | 1,626,056 (3) | 14.4% | ||||||||

Ashford Capital Management, Inc. P.O. Box 4172 Wilmington, DE 19807 | 1,750,000 (4) | 15.5% | ||||||||

Hotchkiss and Wiley Capital Management, LLC 725 Figueroa Street, 39th Floor Los Angeles, CA 90017 | 909,578 (5) | 8.0% | ||||||||

Scopia Management Inc. Matthew Sirovich Jeremy Mindich |  | (6) | 1,469,340 (6) | 13.0% | ||||||

| Jeffrey I. Badgley | 93,200 (7) | * | ||||||||

| Frank Madonia | 54,515 (8) | * | ||||||||

| J. Vincent Mish | 29,901 (9) | * | ||||||||

| A. Russell Chandler, III | 116,209 (10) | 1.0% | ||||||||

| Richard H. Roberts | 49,950 (11) | * | ||||||||

| Paul E. Drack | 46,750 (11) | * | ||||||||

All Directors and Executive Officers as a Group (7 persons) | 2,016,581 (12) | 17.5% | ||||||||

Name and Address of Beneficial Owner | Amount and Nature of Beneficial Ownership (1) | Percent of Class (2) | |||||

| Directors and Executive Officers | |||||||

| A. Russell Chandler, III | 123,916 | (3) | 1.07% | ||||

| Paul E. Drack | 21,709 | * | |||||

| Richard H. Roberts | 17,776 | * | |||||

| William G. Miller | 479,619 | (4) | 4.13% | ||||

| Jeffrey I. Badgley | 25,000 | (5) | * | ||||

| Frank Madonia | 7,501 | (6) | * | ||||

| J. Vincent Mish | 21,101 | (7) | * | ||||

| All Directors and Executive Officers as a Group (7 persons) | 696,622 | (8) | 6.00% | ||||

| Beneficial Owners of More than 5% of the Common Stock | |||||||

Hotchkis and Wiley Capital Management, LLC 725 Figueroa Street, 39th Floor Los Angeles, CA 90017 | 2,088,598 | (9) | 17.99% | ||||

Amica Mutual Insurance Company 100 Amica Way Lincoln, RI 02865 | 1,064,194 | (10) | 9.17% | ||||

Morehead Opportunity Fund, LP 5151 Glenwood Avenue, Suite 300 Raleigh, NC 27612 | 595,053 | (11) | 5.13% | ||||

____________________

| * | Less than one percent. |

| (1) | Includes shares of Common Stock |

| (2) | The percentage of beneficial ownership is based on |

| (3) |

| Includes 36,452 shares held by a limited partnership of which Mr. Chandler’s children are limited partners, and 29,847 shares held in trust for the benefit of Mr. Chandler’s children. Mr. Chandler disclaims beneficial ownership with respect to these shares. |

| As reported in an amendment to Schedule 13D filed with the SEC on January 6, 2009. Does not include 900,000 shares owned by Mr. Miller’s adult children, Christopher Charles Miller, Sarah Louise Miller and William G. Miller, II, with respect to which Mr. Miller disclaims beneficial ownership. | |

| (5) | Includes |

| Includes | |

| (7) | Includes 15,000 shares issuable pursuant to options that are exercisable within 60 days of March 31, 2009. |

6

Annual Compensation (1) | Long-Term Compensation | |||||||||||||||

Awards | ||||||||||||||||

Name and Principal Position | Year | Salary | Bonus ($) | Securities Underlying Options (#) | All Other Compensation ($) (2) | |||||||||||

| William G. Miller | 2005 | $ | 180,000 | $ | - | - | $ | - | ||||||||

Chairman and Co-Chief | 2004 | 180,000 | - | - | - | |||||||||||

Executive Officer | 2003 | 180,000 | - | - | - | |||||||||||

| Jeffrey I. Badgley | 2005 | $ | 276,210 | $ | 30,500 | - | $ | 2,131 | ||||||||

President and Co-Chief Executive | 2004 | 276,210 | - | 100,000 | 2,081 | |||||||||||

Officer | 2003 | 276,210 | - | - | 2,035 | |||||||||||

| Frank Madonia | 2005 | $ | 196,207 | $ | 20,500 | - | $ | 1,980 | ||||||||

Executive Vice President, | 2004 | 196,207 | - | 30,000 | 1,980 | |||||||||||

Secretary and General Counsel | 2003 | 196,207 | - | - | 1,980 | |||||||||||

| J. Vincent Mish | 2005 | $ | 176,206 | $ | 20,500 | - | $ | 1,778 | ||||||||

Executive Vice President and | 2004 | 176,206 | - | 30,000 | 1,770 | |||||||||||

Chief Financial Officer | 2003 | 176,206 | - | - | 1,770 | |||||||||||

| (9) | As reported in an amendment to Schedule 13G filed with the SEC on February 13, 2009 by Hotchkiss and |

| (10) | As reported in a Schedule 13G filed with the SEC on February 11, 2009, by Amica Mutual Insurance Company. |

| (11) | As reported in a Schedule 13D filed with the SEC on October 30, 2008, by Morehead Opportunity Fund, LP and Investor Management Corporation. |

COMPENSATION OF EXECUTIVE OFFICERS AND DIRECTORS

Compensation Discussion and Analysis

Overview

This discussion and analysis addresses the material elements of the Company’s compensation program for named executive officers, including the Company’s compensation objectives and overall compensation philosophy, the compensation process and the administration of the compensation program. It is intended to complement and enhance an understanding of the compensation information presented in the “Summary Compensation Table” and other accompanying tables in this proxy statement.

As used in this proxy statement, the term “named executive officers” means the Company’s Chairman and Co-Chief Executive Officer; President and Co-Chief Executive Officer; Executive Vice President and Chief Financial Officer; and Executive Vice President, Secretary and General Counsel. In this “Compensation Discussion and Analysis” section, the terms “we,” “our,” “us” and the “Committee” refer to the Compensation Committee of the Company’s Board of Directors.

Compensation Objectives and Overall Compensation Philosophy

The Company’s executive compensation program is designed to enhance Company profitability, and thus shareholder value, by aligning executive compensation with the Company’s expectations and performance, and by establishing a system that can retain and reward executive officers who contribute to the long-term success of the Company. More specifically, the overall goals of the executive compensation program include:

| ● | offering competitive total compensation opportunities to retain talented executives; | |

| ● | providing strong links between Company performance and total compensation earned – i.e., paying for performance; | |

| ● | emphasizing the long-term performance of the | |

| ● | promoting and facilitating stock ownership by executive officers. |

We believe that it is in the best interests of the Company’s shareholders and its named executive officers that the Company’s executive compensation program, and each of its elements, remain simple and straightforward. This approach should reduce the time and cost involved in setting the Company’s executive compensation policies and calculating the payments under such policies, and should enhance the transparency of, and the ability to comprehend, these policies.

The Committee has overall responsibility with respect to approving and monitoring the Company’s executive compensation program, and operates under a Charter that was approved by the Company’s Board of Directors in 2004. None of the members of the Committee has been an officer or employee of the Company, and the Board of Directors has considered and determined that all of the members are “independent,” as that term is defined under NYSE rules, and otherwise meet the criteria set forth in the Committee’s Charter.

In fulfilling its responsibilities, the Committee, among other things, establishes and approves the compensation level of each of the named executive officers, reviews and approves corporate goals and objectives relevant to the compensation of the named executive officers, evaluates the performance of the named executive officers in light of these goals and objectives, determines and approves compensation based on these objectives and its evaluations, establishes criteria for granting stock options to the named executive officers and the Company’s other employees, considering the recommendations of senior management, and approves such stock option grants.

7

We regularly review and discuss the compensation of the named executive officers with William G. Miller, the Company’s Chairman and Co-Chief Executive Officer, and consult with Mr. Miller in evaluating the performance of the named executive officers. In addition, Mr. Miller may make recommendations to us regarding compensation for all of the named executive officers, other than for himself.

As discussed in greater detail below, the levels of each element of compensation for the named executive officers are determined based on several factors, which may include the Company’s historical performance and relative shareholder return, our informal assessment of compensation paid to executives in comparable industries, the amount and the elements of compensation provided in previous years, the terms of each named executive officer’s employment agreement with the Company, our expectations for the Company’s future financial performance and other matters that we deem relevant. In addition, we consider the level of experience and the responsibilities of each named executive officer, his performance and the personal contributions he makes to the success of the Company. Leadership skills, analytical skills, organization development, public affairs and civic involvement have been and will continue to be deemed to be important qualitative factors to take into account in considering elements and levels of compensation. We have not adopted any formal or informal policy for allocating compensation between long-term and short-term elements, between cash and non-cash or among the different possible forms of non-cash compensation.

In 2008, the Company’s executive compensation program consisted of three primary elements: base salary, annual discretionary cash bonuses (which are disclosed in the “Summary Compensation Table” under the “Bonus” column) and stock option awards. In addition to these primary elements, the Company has provided, and will continue to provide, its named executive officers with certain benefits, such as healthcare plans, that are available to all employees.

Elements of Compensation

Annual Discretionary Cash Bonuses. We utilize annual discretionary cash bonuses to provide additional compensation to the named executive officers, and to reward them for their performance. We have not adopted any formal or informal performance or other objectives for the calculation or payment of these discretionary bonuses. Instead, in determining an annual discretionary bonus, we consider, among other things, the Company’s performance for the previous year and relative shareholder value, discretionary bonuses awarded in previous years, the performance of the named executive officer and his personal contributions to the success of the Company.

8

Annual discretionary cash bonuses, as opposed to grants of stock options or other equity-based awards, are designed to provide additional compensation to the named executive officers, and to more immediately reward them for their performance. The immediacy of these bonuses provides an incentive to the named executive officers to raise their level of performance, and thus the Company’s overall level of performance. Thus, we believe that discretionary cash bonuses are an important motivating factor for the named executive officers.

We approved the payment of cash bonuses in 2008 to Messrs. Badgley, Mish and Madonia in the amounts set forth in the “Summary Compensation Table.” Taking into account the Company’s overall performance in 2007, and the reductions in base salary for 2008, the bonus amounts paid to Messrs. Badgley, Mish and Madonia were approximately 30% less than the bonus amounts paid for the prior year period. In 2008, as in prior years, Mr. Miller declined an annual cash bonus from the Company.

Stock options and other equity-based awards provide the named executive officers with a strong link to the Company’s long-term performance, promote an ownership culture and more closely align the interest of the named executive officers and the Company’s shareholders. Equity incentive awards are granted under the Company’s 2005 Equity Incentive Plan. This plan provides us with broad discretion to fashion the terms of awards to provide eligible participants with such stock-based incentives as we deem appropriate. It permits the issuance of awards in a variety of forms, including non-qualified stock options and incentive stock options, stock appreciation rights, restricted stock awards and performance shares.

In general, options for the purchase of 500 or more shares vest in four equal annual installments, and all options for the purchase of fewer than 500 shares vest in two equal annual installments. All stock options are exercisable until the tenth anniversary of the grant date unless otherwise earlier terminated pursuant to the terms of the individual option agreement.

We approved the award of stock options in 2008 to Messrs. Badgley, Mish and Madonia in the amounts set forth in the “Grants of Plan-Based Awards Table.” The decision to grant awards in 2008, and the determination of the size of the awards, were based on, among other things, the lower levels of equity ownership by the named executive officers relative to prior periods and our desire for these levels of ownership to be more significant to the named executive officers. In light of the reductions in the named executive officers’ base salaries and the reductions in their discretionary cash bonus amounts, we also believe that the grant of equity awards will provide a form of remuneration with an attractive opportunity for long-term growth. In 2008, Mr. Miller declined any equity awards from the Company as he has historically done.

Severance and Change of Control Arrangements. As discussed in more detail in the “Additional Discussion of Material Items in Summary Compensation Table―Employment Agreements with Named Executive Officers” and “Potential Payments Upon Termination or Change in Control” sections below, the named executive officers may be entitled to certain benefits upon the termination of their respective employment or change in control agreements.

Other Compensation. The named executive officers currently are entitled to participate in the Company’s health, life and disability insurance plans and in our 401(k) plan to the same extent that the Company’s employees are entitled to participate.

2009 Compensation Decisions. For 2009, taking into account the current economic conditions and our expectations for the Company’s financial performance in this difficult economic environment, the base salary for each named executive officer was increased 1.5%, which is the same rate at which compensation for all other employees was increased in 2009, resulting in the reductions in base salary for 2008 being continued in large part. Additionally, based primarily on the Company's performance in 2008, we determined not to pay an annual discretionary cash bonus to the named executive officers in 2009.

9

Report of the Compensation Committee

The Compensation Committee has reviewed and discussed with management the Compensation Discussion and Analysis contained under that heading in this proxy statement. On the basis of its reviews and discussions, the Committee has recommended that the Compensation Discussion and Analysis be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 20052008, and this proxy statement.

| Compensation Committee | ||

| Paul E. Drack | ||

| A. Russell Chandler, III | ||

| Richard H. Roberts |

Compensation Committee Interlocks and Insider Participation

During 2008, the Compensation Committee was comprised of Messrs. Chandler, Drack and Roberts, all of whom were non-employee, independent directors. During 2008, no executive officer of the Company served as a member of the board of directors or compensation committee of any other entity whose executive officer(s) served on the Company’s Board of Directors or Compensation Committee.

Summary Compensation Table

The following table summarizes certain information regarding option values ofsets forth the Namedcompensation awarded to, earned by, or paid by the Company during the years ended December 31, 2008, 2007 and 2006, respectively, to the Company’s Co-Chief Executive Officers, Chief Financial Officer and the Company’s other most highly compensated executive officer (who are referred to together as of December 31, 2005.the Company’s named executive officers).

Number of Securities Underlying Unexercised Options At Fiscal Year-End (#) | Value of Unexercised In-The-Money Options At Fiscal Year-End ($) (1) | ||||||||||||

Name | Exercisable | Unexercisable | Exercisable | Unexercisable | |||||||||

| William G. Miller | - | - | $ | - | $ | - | |||||||

| Jeffrey I. Badgley | 60,200 | 75,000 | 467,340 | 898,500 | |||||||||

| Frank Madonia | 32,900 | 22,500 | 198,940 | 269,550 | |||||||||

| J. Vincent Mish | 16,400 | 22,500 | 198,940 | 269,550 | |||||||||

Name and Principal Position | Year | Salary (1) | Bonus (2) | Option Awards (3) | All Other Compensation | Total | ||||||||||||||||

| William G. Miller | 2008 | $ | 283,500 | (4) | $ | – | $ | – | $ | – | $ | 283,500 | ||||||||||

| Chairman and Co-Chief Executive Officer | 2007 | $ | 258,753 | (4) | $ | – | $ | – | $ | – | $ | 258,753 | ||||||||||

| 2006 | $ | 180,007 | $ | – | $ | – | $ | – | $ | 180,007 | ||||||||||||

| Jeffrey I. Badgley | 2008 | $ | 283,500 | $ | 47,150 | $ | 32,592 | $ | 7,138 | (5) | $ | 370,380 | ||||||||||

| President and Co-Chief Executive Officer | 2007 | $ | 310,833 | $ | 69,250 | $ | 90,529 | $ | 7,484 | (5) | $ | 478,096 | ||||||||||

| 2006 | $ | 290,003 | $ | 60,600 | $ | 90,529 | $ | 5,629 | (5) | $ | 446,761 | |||||||||||

| Frank Madonia | 2008 | $ | 193,500 | $ | 33,150 | $ | 10,109 | $ | 5,570 | (5) | $ | 242,329 | ||||||||||

| Executive Vice President, Secretary and | 2007 | $ | 212,917 | $ | 46,250 | $ | 27,159 | $ | 5,642 | (5) | $ | 291,968 | ||||||||||

| General Counsel | 2006 | $ | 202,502 | $ | 40,600 | $ | 27,159 | $ | 4,564 | (5) | $ | 274,825 | ||||||||||

| J. Vincent Mish | 2008 | $ | 193,500 | $ | 33,150 | $ | 10,109 | $ | 5,122 | (5) | $ | 241,881 | ||||||||||

| Executive Vice President, Treasurer and | 2007 | $ | 210,833 | $ | 46,250 | $ | 27,159 | $ | 4,683 | (5) | $ | 288,925 | ||||||||||

| Chief Financial Officer | 2006 | $ | 190,002 | $ | 40,600 | $ | 27,159 | $ | 3,739 | (5) | $ | 261,500 | ||||||||||

____________________

| (1) | |

| (2) | Discretionary cash bonus awarded to the named executive officer based on, among other factors, the Company’s performance in the previous year. |

| (3) | Amounts represent compensation costs recognized by the |

| (4) | Beginning in July 2007, the Compensation Committee determined to adjust Mr. Miller’s salary on a going-forward basis to match the salary of the other Co-Chief Executive Officer in accordance with Mr. Miller's employment agreement. |

| (5) | Amount represents the Company’s contribution to the named executive officer’s 401(k) plan under the plan’s matching program. No other amounts are indicated for perquisites and personal benefits as |

10

Grants of Plan-Based Awards Table

The following table sets forth information with respect to stock option awards granted to the named executive officers in 2008.

Name | Grant Date | All Other Option Awards: Number of Securities Underlying Options (#) | Exercise or Base Price of Option Awards ($/Sh) | Grant Date Fair Value of Option Awards | ||||||||||||

| William G. Miller | – | – | – | – | ||||||||||||

| Jeffrey I. Badgley | 11/07/2008 | 120,000 | $ | 5.49 | $ | 238,800 | ||||||||||

| Frank Madonia | 11/07/2008 | 40,000 | $ | 5.49 | $ | 79,600 | ||||||||||

| J. Vincent Mish | 11/07/2008 | 40,000 | $ | 5.49 | $ | 79,600 | ||||||||||

When awarding grants, the Compensation Committee sets option exercise prices at the market closing price on the date of grant. Stock options vest over a number of years in order to encourage employee retention and focus management’s attention on sustaining financial performance and building shareholder value over an extended term. Typically, vesting is in equal increments over a four-year period from the date of the grant.

Additional Discussion of Material Items in Summary Compensation Table

The Company’s executive compensation policies and practices, pursuant to which the compensation set forth in the Summary Compensation Table was paid or awarded, are described above under “Compensation Discussion and Analysis.” A summary of certain material terms of the Company’s compensation plans and arrangements is set forth below.

Employment Contracts, Termination of Employment and Change-in-Control ArrangementsAgreements with Named Executive Officers

William G. Miller. In December 2002,July 1997, the Company entered into an employment agreement with Mr. Mish. The employment agreement provides for a rolling three-year term, extended automatically as of each annual shareholders’ meeting such that the remaining term of the employment agreement is three years as of that date. Notwithstanding the foregoing, the term of the agreement ends on Mr. Mish’s 65th birthday.Miller which was amended and restated in December 2008. The employment agreement provides for a base salary of $175,000, subjectas agreed to annual review by the Board of Directors. Additionally,Company and Mr. Mish may participateMiller from time to time, but which shall in any bonus plans or other benefits generally available to executive officersevent be substantially the same as the base salary of the Chief Executive Officer of the Company. TheMr. Miller also receives certain insurance and other benefits as are generally provided by the Company may terminateto its executive employees. Mr. Mish pursuant to thisMiller’s employment agreement for any reason upon written notice. However, if termination is for an indeterminate term and allows Mr. Miller to pursue other than “just cause” (asbusiness related interests as long as they do not interfere with his duties for the Company. Employment may be terminated by either party upon three years’ written notice or for “cause,” as defined in the employment agreement), 100% of Mr. Mish’s options on Company stock granted pursuant to the Company’s Stock Option and Incentive Plan will vest and become immediately exercisable, and the Company must pay Mr. Mish his current base salary plus bonuses and health and life insurance benefits for a period of three years, or until the end of the term of the employment agreement, whichever is shorter. Finally, the employment agreement also provides for non-competition and confidentiality during employment and for a period ending two years from termination or expiration of the employment agreement (or one year if termination occurs pursuant to a change in control).agreement.

Jeffrey I. Badgley and Frank Madonia. In September 1998, the Company entered into employment agreements with Messrs. Badgley and Madonia.Madonia which were amended and restated in December 2008. Each employment agreement provides for a rolling three-year term, extended automatically each day for an additional day such that the remaining term of each employment agreement is three years. However, on each individual’s 62ndnd birthday, the employment agreement ceases to extend automatically, and instead terminates three years from that date. The employment agreements provide for base salaries of $200,000 to Mr. Badgley, and $165,000 to Mr. Madonia, eachthat are subject to annual review and adjustment by the Board of Directors. Additionally, each individual may participate in any bonus plans or other benefits generally available to executive officers of the Company. The Company may terminate Messrs. Badgley or Madonia pursuant to their respective employment agreements for any reason upon written notice. However, if termination is for other than “just cause” (as defined in the employment agreements), 100% of the terminated individual’s options on Company stock granted pursuantindividual is entitled to certain benefits described under the Company’s Stock Option and Incentive Plan will vest and become immediately exercisable, andheading “Potential Payments Upon Termination or Change in Control” below.

J. Vincent Mish. In December 2002, the Company must pay the terminated individual his current base salary plus bonusesentered into an employment agreement with Mr. Mish which was amended and health and life insurance benefitsrestated in December 2008. The employment agreement provides for a periodrolling three-year term, extended automatically as of three years, or untileach annual shareholders’ meeting such that the end of theremaining term of the employment agreement whichever is shorter. Finally,three years as of that date. Notwithstanding the foregoing, the term of the agreement ends on Mr. Mish’s 65th birthday. The employment agreement provides for base salary that is subject to annual review and adjustment by the Board of Directors. Additionally, Mr. Mish may participate in any bonus plans or other benefits generally available to executive officers of the Company. The Company may terminate Mr. Mish pursuant to this employment agreement for any reason upon written notice. However, if termination is for other than “just cause” (as defined in the employment agreement), Mr. Mish is entitled to certain benefits described under the heading “Potential Payments Upon Termination or Change in Control” below.

11

2005 Equity Incentive Plan

The Company’s shareholder-approved 2005 Equity Incentive Plan is a flexible plan that provides the Compensation Committee with broad discretion to fashion the terms of awards to provide eligible participants with such equity-based incentives as the Committee deems appropriate. It permits the issuance of awards in a variety of forms, including non-qualified stock options and incentive stock options, stock appreciation rights, restricted stock awards and performance shares. During 2008, options to purchase an aggregate of 200,000 shares of Common Stock were granted to the Company’s named executive officers under the 2005 Equity Incentive Plan.

Contributory Retirement Plan

The Company maintains a contributory retirement plan for all full-time employees with at least 90 days of service. The plan is designed to provide tax-deferred income to the Company’s employees in accordance with the provisions of Section 401(k) of the Internal Revenue Code. The plan provides that each participant may contribute up to 15% of his or her salary. For 2008, the Company matched 50% of the first 5% of participant contributions. Matching contributions vest over the first five years of employment.

Outstanding Equity Awards at Fiscal Year-End 2008

The following table provides information on the holdings of stock options by the named executive officers, including both unexercised and unvested awards, at December 31, 2008.

| Option Grant | Number of Shares Underlying Unexercised Options | Option | Option Expiration | |||||||||||||||||

| Name | Date (1) | Exercisable | Unexercisable | Exercise Price | Date | |||||||||||||||

| William G. Miller | – | – | – | $ | – | – | ||||||||||||||

| Jeffrey I. Badgley | 3/26/2004 | 25,000 | – | $ | 8.31 | 3/26/2014 | ||||||||||||||

| 11/07/2008 | – | 120,000 | 5.49 | 11/06/2018 | ||||||||||||||||

| Frank Madonia | 3/26/2004 | 7,500 | – | $ | 8.31 | 3/26/2014 | ||||||||||||||

| 11/07/2008 | – | 40,000 | 5.49 | 11/06/2018 | ||||||||||||||||

| J. Vincent Mish | 3/26/2004 | 15,000 | – | $ | 8.31 | 3/26/2014 | ||||||||||||||

| 11/07/2008 | – | 40,000 | 5.49 | 11/06/2018 | ||||||||||||||||

____________________

| (1) | Vesting for each listed stock option grant occurs in 25% increments on each yearly anniversary of the date of grant. |

Option Exercises and Stock Vested in 2008

There were no stock options exercised by any of the named executive officers during 2008.

Potential Payments Upon Termination or Change in Control

The Company is party to employment agreements with each of its named executive officers, and has also entered into change in control agreements with three of its named executive officers. Each of these employment and change in control agreements address, among other things, compensation and benefits that would be paid to the applicable named executive officer in the event that his employment is terminated for different reasons, including termination for cause or without cause, and termination in connection with a change in control.

12

Employment Agreements

William G. Miller. The Company’s employment agreement with Mr. Miller provides that either the Company or Mr. Miller may terminate the agreement for any reason upon three years’ prior notice, that Mr. Miller may terminate the agreement upon 60 days’ notice in the event of a change in control of the Company, and that the Company may terminate the agreement at any time for “cause,” or if Mr. Miller dies or becomes disabled. Under the employment agreement:

| ● | Upon any termination of Mr. Miller’s employment for “cause,” Mr. Miller will be entitled to receive all compensation due to him through his last day of employment. | |

| ● | If Mr. Miller’s employment is terminated due to death or disability, the Company will have no further liability under the employment agreement. | |

| ● | If Mr. Miller’s employment is terminated by the Company without “cause” without the required three year's prior notice or, if such notice has been given, prior to the end of the three-year notice period, Mr. Miller will be entitled to receive a lump sum pro-rated bonus (based on the average monthly bonus earned by him for the three calendar years immediately preceding the year in which his employment is terminated) for the number of days he worked during the year in which his employment is terminated, and Mr. Miller will be entitled to receive, monthly over the shorter of a 36-month period or the remaining portion of the three-year notice period: (i) his then-current base salary; (ii) the average monthly bonus earned by him for the three calendar years immediately preceding the year in which his employment is terminated; and (iii) continued health and life insurance coverage. |

Under the employment agreements, “cause” means: (i) willful malfeasance or gross negligence; or (ii) knowingly engaging in wrongful conduct resulting in detriment to the goodwill of the Company or damage to the Company’s relationships with its customers, suppliers or employees. The employment agreement also provides for confidentiality during employment, and for non-competition during employment and for a three-year period from termination if the Company terminates the agreement for cause or Mr. Miller terminates his employment in breach of the agreement.

Jeffrey I. Badgley, Frank Madonia and J. Vincent Mish. The Company’s employment agreements with Messrs. Badgley, Madonia and Mish address the rights and obligations of the Company in connection with the termination of the executive’s employment in different situations including in connection with a change in control of the Company. Under each agreement:

| ● | Upon any termination of the executive’s employment, including if the executive terminates his employment voluntarily, or if the Company terminates the executive’s employment for “just cause,” the executive will be entitled to receive all compensation due to him through his last day of employment. | |

| ● | If the executive’s employment is terminated due to death, the executive’s beneficiary will be entitled to receive, in one lump sum, an amount equal to: (i) 12 months of his then-current base salary; (ii) 12 months of the average monthly bonus earned by him for the three calendar years immediately preceding the year in which his employment is terminated; and (iii) a pro-rated bonus, based on the average monthly bonus earned by him for the three calendar years immediately preceding the year in which his employment is terminated, for the number of days he worked during the year in which his employment is terminated. | |

| ● | If the executive’s employment is terminated due to disability, all of the executive’s outstanding stock options will vest and become exercisable, the executive (or his beneficiary) will be entitled to receive a lump sum pro-rated bonus (based on the average monthly bonus earned by him for the three calendar years immediately preceding the year in which his employment is terminated) for the number of days he worked during the year in which his employment is terminated, and the executive (or his beneficiary) will be entitled to receive, monthly over a period of 24 months from the last day of employment: (i) his then-current base salary; (ii) the average monthly bonus earned by him for the three calendar years immediately preceding the year in which his employment is terminated; and (iii) continued health and life insurance coverage. | |

| ● | If the executive’s employment is terminated by the Company without “just cause,” or if the executive’s employment is terminated under circumstances that would entitle him to receive benefits under his change in control agreement (i.e., in connection with a change in control of the Company) with the Company, if any, all of the executive’s outstanding stock options will vest and become exercisable, the executive will be entitled to receive a lump sum pro-rated bonus (based on the average monthly bonus earned by him for the three calendar years immediately preceding the year in which his employment is terminated) for the number of days he worked during the year in which his employment is terminated, and the executive will be entitled to receive, monthly over the shorter of a 36-month period or the remaining term of the employment agreement: (i) his then-current base salary; (ii) the average monthly bonus earned by him for the three calendar years immediately preceding the year in which his employment is terminated; and (iii) continued health and life insurance coverage; provided, that if the executive dies during the post-termination period in which these benefits are being paid, the monthly base salary and bonus payments will continue for the shorter of 12 months after his death or the remaining term of the employment agreement. |

13

Under the employment agreements, “just cause” means: (i) executive’s material fraud, malfeasance, gross negligence or willful misconduct with respect to the business affairs of the Company which is directly or materially harmful to the business or reputation of the Company or its subsidiaries, and which is incapable of being remedied or not remedied within 30 days of notice from the Company; (ii) executive’s conviction of or failure to contest prosecution for a felony or a crime involving moral turpitude; or (iii) executive’s material breach of the employment agreement which is incapable of being remedied or not remedied within 30 days of notice from the Company.

Each employment agreement also provides for non-competition and confidentiality during employment and for a period ending two years from termination or expiration of the employment agreement (or one year if termination occurs pursuant to a change in control as defined in each individual’s change in control agreement described below)control).

Change in Control Agreements

In September 1998, the Company entered into change in control agreements with Messrs. Badgley and Madonia. EachMadonia, and in December 2002, the Company entered into a change in control agreement provideswith Mr. Mish. The change in control agreements with Messrs. Badgley, Madonia and Mish were amended and restated in December 2008. Under each agreement, if the executive’s employment is terminated within six months before, or 24 months after, a “change in control” of the Company, and the termination was either involuntary on the part of the executive (other than for a rolling three-year term, extended automatically each day for an additional day suchcause, disability or death), or “voluntary” on the part of the executive, then all of the executive’s outstanding stock options will vest and become exercisable, and the executive will be entitled to receive:

| ● | a lump sum payment equal to the present value of 36 months of: | ||

| - | his then-current base salary; and | ||

| - | the average monthly bonus earned by him for the three calendar years immediately preceding the year in which his employment is terminated; | ||

| ● | a lump sum pro-rated bonus, based on the average monthly bonus earned by him for the three calendar years immediately preceding the year in which his employment is terminated, for the number of days he worked during the year in which his employment is terminated, discounted to present value; and | ||

| ● | health and life insurance benefits over the shorter of a 36-month period or the remaining term of the employment agreement. | ||

However, any amounts paid under the change in control agreements will be reduced to the extent that the remaining termexecutive receives or is entitled to receive payments in respect of eachthe change in control under the executive’s employment agreement. If the executive does not actually receive payments under the employment agreement, or the employment agreement is three years. However, on each individual’s 62nd birthday,breached by the employment agreement ceases to extend automatically, and instead terminates three years from that date. Upon termination within 6 months prior to or 2 years after aCompany, payments will be made under the change in control (as defined in each respectiveagreement. Additionally, under the change in control agreement), Messrs. Badgleyagreements, the Company has agreed to provide the executive with a gross-up payment for federal and Madonia are entitled to payment of then current salary, plus bonusesstate income taxes and incentives, and health and life insurance coverage for a period of three years following termination.federal excise taxes imposed on any “excess parachute payment.”

14

Under the Company entered into anchange in control agreements, “voluntary” termination by the executive means termination of employment agreementthat is voluntary on the part of the executive, and, in the judgment of the executive, is due to: (i) a reduction of the executive’s responsibilities, title or status resulting from a formal change in title or status, or from the assignment to the executive of any duties inconsistent with Mr. Miller which provides forhis title, duties or responsibilities in effect within the year prior to the change in control, (ii) a base salary as agreedreduction in the executive’s compensation or benefits, or (iii) a Company-required involuntary relocation or the executive’s place of residence or a significant increase in the executive’s travel requirements.

Potential Payments

Assuming that a termination event or change in control occurred on December 31, 2008, the value of potential payments and benefits payable to each named executive officer who was employed by the Company and Mr. Miller from time to time, but which shallon such date is summarized in any event be substantially the same as the base salaryfollowing table. The price per share of Common Stock used for purposes of the Chief Executive Officerfollowing calculation is the closing market price on the NYSE as of December 31, 2008, the last trading day in 2008, which was $5.30. The table excludes (i) amounts accrued through December 31, 2008 that would be paid in the normal course of continued employment, such as accrued but unpaid salary, (ii) vested account balances in the Company’s contributory retirement plan that are generally available to all of the Company’s U.S. salaried employees, and (iii) any amounts to be provided under any arrangement that does not discriminate in scope, terms or operation in favor of named executive officers and that is available generally to all salaried employees. Actual amounts to be paid can only be determined at the time of such executive’s termination.

Name and payment or benefit | Termination by Company without just cause | Involuntary termination by Company or “voluntary” termination by executive after change in control | Disability | Death | ||||||||||||

| William G. Miller | ||||||||||||||||

| Salary and bonus | $ | 850,500 | (1) | �� | $ | 850,000 | (1) | $ | – | $ | – | |||||

| Healthcare and life insurance coverage | 14,465 | (2) | 14,465 | (2) | – | – | ||||||||||

| Tax gross-up | – | 334,633 | (3) | – | – | |||||||||||

| Market value of stock options vesting on termination | – | – | – | – | ||||||||||||

| Jeffrey I. Badgley | ||||||||||||||||

| Salary and bonus | $ | 1,086,500 | (1) | $ | 1,086,500 | (1) | $ | 744,000 | (4) | $ | 401,500 | (5) | ||||

| Healthcare and life insurance coverage | 40,750 | (2) | 40,750 | (2) | 27,167 | (6) | – | |||||||||

| Tax gross-up | – | – | – | – | ||||||||||||

| Market value of stock options vesting on termination | 636,000 | 636,000 | 636,000 | 636,000 | ||||||||||||

| Frank Madonia | ||||||||||||||||

| Salary and bonus | $ | 740,500 | (1) | $ | 740,500 | (1) | $ | 507,000 | (4) | $ | 273,500 | (5) | ||||

| Healthcare and life insurance coverage | 28,507 | (2) | 28,507 | (2) | 19,005 | (6) | – | |||||||||

| Tax gross-up | – | – | – | – | ||||||||||||

| Market value of stock options vesting on termination | 212,000 | 212,000 | 212,000 | 212,000 | ||||||||||||

| J. Vincent Mish | ||||||||||||||||

| Salary and bonus | $ | 740,500 | (1) | $ | 740,500 | (1) | $ | 507,000 | (4) | $ | 273,500 | (5) | ||||

| Healthcare and life insurance coverage | 39,166 | (2) | 39,166 | (2) | 26,111 | (6) | – | |||||||||

| Tax gross-up | – | 269,435 | (3) | – | – | |||||||||||

| Market value of stock options vesting on termination | 212,000 | 212,000 | 212,000 | 212,000 | ||||||||||||

____________________

| (1) | Reflects the value of (i) monthly payments over the shorter of 36 months or the remaining term of the executive’s employment agreement of salary and average monthly bonus and (ii) a lump sum pro-rated bonus, based on average monthly bonus, for the number of days worked by the executive during the year in which his employment is terminated. |

| (2) | Reflects the employer share of premiums for continued healthcare and life insurance coverage for 36 months. |

15

| (3) | The tax gross-up payment payable for the executive was estimated without assigning a value to the restrictive covenants to which he would be subject under his employment and change in control agreement, if any, with the Company following termination. |

| (4) | Reflects the value of (i) monthly payments over 24 months of salary and average monthly bonus and (ii) a lump sum pro-rated bonus, based on average monthly bonus, for the number of days worked by the executive during the year in which his employment is terminated. |

| (5) | Reflects the value of a lump sum payment of (i) 12 months of salary and average monthly bonus and (ii) pro-rated bonus, based on average monthly bonus, for the number of days worked by the executive during the year in which his employment is terminated. |

| (6) | Reflects the employer share of premiums for continued healthcare and life insurance coverage for 24 months. |

Non-Employee Director Compensation for 2008

The current compensation program for the Company’s non-employee directors is designed to pay directors for work required for a company of Miller Industries’ size and scope and to align the director’s interests with the long-term interests of Company unless Mr. Miller agreesshareholders.

Non-employee directors receive annual compensation comprised of a cash component and an equity component. Under the cash component, each non-employee director receives an annual cash payment of $25,000 as compensation for service on the Board of Directors. Additionally, each non-employee director receives a cash payment of $3,000 for each Board of Directors meeting that he attends and a cash payment of $1,000 for each committee meeting that he attends. Under the equity component, each non-employee director is entitled to accept a lower salary. Mr. Miller also receives certain insurance and other benefits as are generally providedan annual award under the Company’s Non-Employee Director Stock Plan, to be paid in fully-vested shares of Common Stock, equal to $25,000 divided by the Company to its executive employees. Mr. Miller's employment agreement is for an indeterminate term and allows Mr. Miller to pursue other business related interests as long as they do not interfere with his duties for the Company. Employment may be terminated by either party upon three years written notice or for “cause,” as defined in the employment agreement. The agreement also provides for non-competition by Mr. Miller for a period ending three years from terminationclosing price of the agreement ifCommon Stock on the agreement is terminated becausefirst trading day of a breach by Mr. Miller.

The Company’s general policies on executive officer compensation are administered by the Compensation Committeemembers of the Board of Directors (the “Compensation Committee”); however, the Compensation Committee submits its determinations to the full Board of Directors for its comments and concurrence. It is the responsibility of the Compensation Committee to determine whether the Company’s executive compensation policieswho are reasonable and appropriate, meet the Company’s stated objectives on executive compensation and effectively serve the best interestsemployees of the Company and its shareholders.do not receive additional compensation for Board or committee service.

Name | Fees Earned or Paid in Cash | Stock Awards | Total | |||||||||

A. Russell Chandler, III (1) | $ | 43,000 | $ | 25,000 | $ | 68,000 | ||||||

Paul E. Drack (1) | $ | 43,000 | $ | 25,000 | $ | 68,000 | ||||||

Richard H. Roberts (1) | $ | 43,000 | $ | 25,000 | $ | 68,000 | ||||||

____________________

| (1) | Member of the Audit, Compensation and Nominating Committees of the Board of Directors. |

In determining the compensation to be paid to the executive officersMarch 2009, in light of the Company, the Compensation Committee considerscurrent economic conditions and expectations for the Company’s financial performance its annual budget, its position within its industry sectors, its knowledge of compensation paid to executives of companies of comparable size and complexity, andin 2009, the non-employee directors reduced by 10% the compensation policiesthat each of similar companies in its business sectors. In addition, the Compensation Committee considers the level of experience and the responsibilities of each executive as well as the personal contributions a particular individual may make to the success of the corporate enterprise. Such qualitative factors as leadership skills, analytical skills, organization development, public affairs and civic involvement have been and will continue to be deemed to be important qualitative factors to take into account in considering levels of compensation.

ACCOUNTING MATTERS

Audit Committee Report

The Company’s Audit Committee is comprised of three independent members, as required by applicable listing standards of the NYSE. The Audit Committee acts pursuant to a written charter,Charter, which was amended and restated by the Board of Directors in February 2004.March 2007. The Company’s management is responsible for its internal accounting controls and the financial reporting process. The Company’s independent accountants, Joseph Decosimo and Company, PLLC, are responsible for performing an audit of the Company’s consolidated financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States) and for expressing an opinion as to their conformity with generally accepted accounting principles. The Audit Committee’s responsibility is to monitor and oversee these processes.

16

In keeping with that responsibility, the Audit Committee has reviewed and discussed the Company’s audited consolidated financial statements with management and the independent accountants. In addition, the Audit Committee has discussed with the Company’s independent accountants the matters required to be discussed by Statement on Auditing Standards No. 61, “Communications with Audit Committee,” as currently in effect. In addition, the Audit Committee has received the written disclosures from the independent accountants required by Independence Standards Board Standard No. 1, “Independence Discussions with Audit Committees,” and has discussed with the independent accountants their independence. The Audit Committee has also considered whether the provision of non-audit services by the independent accountants is compatible with maintaining such accountants’ independence.

The members of the Audit Committee are not professionally engaged in the practice of auditing or accounting and are not experts in the fields of accounting or auditing, including in respect of auditor independence. Members of the Committee rely without independent verification on the information provided to them and on the representations made by management and the independent accountants. Accordingly, the Audit Committee’s oversight does not provide an independent basis to determine that management has maintained appropriate accounting and financial reporting principles or appropriate internal control and procedures designed to assure compliance with accounting standards and applicable laws and regulations. Furthermore, the Audit Committee’s considerations and discussions referred to above do not assure that the audit of the Company’s consolidated financial statements has been carried out in accordance with the standards of the Public Company Accounting Oversight Board (United States), that the consolidated financial statements are presented in accordance with generally accepted accounting principles, or that the Company’s auditors are in fact “independent”.“independent.”

Based on the reports and discussions described in this report, and subject to the limitations on the role and responsibilities of the Committee referred to above and in the Audit Committee Charter, the Audit Committee recommended to the Board of Directors that the audited consolidated financial statements of the Company be included in the Annual Report on Form 10-K for the year ended December 31, 20052008 for filing with the SEC.

This report is respectfully submitted by the Audit Committee of the Board of Directors.

| Audit Committee | ||

| Paul E. Drack | ||

| A. Russell Chandler, III | ||

| Richard H. Roberts |

Independent Public Accountants

General

Joseph Decosimo and Company, PLLC were the Company’s independent public accountants for 2005,2008, and the Company anticipates that Joseph Decosimo and Company, PLLC will be retained as the Company’s independent public accountants for 2006.2009. Representatives of Joseph Decosimo and Company, PLLC are expected to be present at the Annual Meeting, and will have the opportunity to make statements and to respond to appropriate questions.

The decision to engage Joseph Decosimo and Company, PLLC was made upon the recommendation of the Company’s Audit Committee and the approval of the Board of Directors. During 2004 and 2005, the Company has not consulted with Joseph Decosimo and Company, PLLC regarding any matter requiring disclosure under Regulation S-K, Item 304(a)(2)(i) and (ii).

Audit Fees

Joseph Decosimo and Company, PLLC billed fees of $185,000,$289,500 and expects to bill up to an additional $90,000 in fees,$263,000 for 2005,2008 and billed $353,355 for 2004,2007, respectively, for professional services rendered for the audit of the Company’s consolidated financial statements the review ofincluded within the Company’s Form 10-K, and review of interim consolidated financial statements included within Forms 10-QForm 10-Qs during such periods, and for the audit of management’s assessment ofthe Company’s internal controlscontrol over financial reporting and the re-audit of the Company’s 2002 consolidated financial statements.reporting.

17

Audit-Related Fees

Joseph Decosimo and Company, PLLC did not perform any, or bill the Company for, assurance and related services related to the performance of the audit and review of financial statements for 20052008 or 2004.

2007.

Tax Fees

Joseph Decosimo and Company, PLLC did not perform or bill the Company for any tax services in 2005. Joseph Decosimobilled fees of $86,600 and Company, PLLC billed the Company $30,000$89,000 for tax services during 2004 for foreign2008 and state tax reviews.2007, respectively.

All Other Fees

Joseph Decosimo and Company, PLLC did not perform or bill the Company for any other services during 20052008 or 2004.2007.

Approval of Audit and Non-Audit Services

The Audit Committee of the Board of Directors pre-approves all audit and non-audit services performed by the Company’s independent auditor. The Audit Committee specifically approves the annual audit services engagement. Certain non-audit services that are permitted under the federal securities laws may be approved from time to time by the Audit Committee.

CODE OF BUSINESS CONDUCT AND ETHICS

The Company has adopted a Code of Business Conduct and Ethics that applies to its directors, officers and employees. A copy of the Code is available on the Company’s website at www.millerind.com through the “Investor Relations” link. A copy of the Code can also be obtained upon request from the Company’s Corporate Secretary.

EQUITY COMPENSATION PLAN INFORMATION

The following table sets forth aggregate information as of December 31, 20052008 about all of the Company’s compensation plans, including individual compensation arrangements, under which the Company’s equity securities are authorized for issuance.

Plan category | Number of securities to be issued upon exercise of outstanding options, warrants and rights | Weighted-average exercise price of outstanding options, warrants and rights | Number of securities remaining available for future issuance under equity compensation plans | |||||||||

Equity compensation plans approved by security holders | 128,565 | (1) | $ | 8.25 | (1) | See Note (2) | ||||||

Equity compensation plans not approved by security holders | 0 | 0 | 0 | |||||||||

____________________

| (1) | Includes only options outstanding under the Company’s 1994 Stock Option Plan and 2005 Equity Incentive Plan. Does not include shares of common stock issued to non-employee directors under the Company’s Non-Employee Director Stock Plan, which shares are fully vested and exercisable upon |

| (2) | The 1994 Stock Option Plan expired in August 2004, therefore no securities are available for future issuance under this plan. As of December 31, 2008, there were 563,640 securities available for future issuance under the 2005 Equity Incentive Plan. Grants are made annually to non-employee directors under the Non-Employee Director Stock Plan, and the number of shares of common stock to be granted to each non-employee director for a particular year is determined by dividing $25,000 by the closing price of a share of the Company common stock on the first trading day of such year. Therefore, the number of securities remaining available for future issuance under the Non-Employee Director Stock Plan is not presently determinable. |

COMPLIANCE WITH SECTION 16(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

Section 16(a) of the Securities Exchange Act of 1934 and the disclosure requirements of Item 405 of Regulation S-K require the directors and executive officers of the Company, and any persons holding more than 10% of any class of equity securities of the Company, to report their ownership of such equity securities and any subsequent changes in that ownership to the Securities and Exchange Commission, the NYSE and the Company. Based solely on a review of the written statements and copies of such reports furnished to the Company by its executive officers and directors, the Company believes that, during 2005, each of Messrs. Chandler, Drack and Roberts filed one late report on Form 4 reflecting the receipt of stock under the Company’s Non-Employee Director Stock Plan, and the Company is not aware of any other2008, all Section 16(a) filing delinquencies.requirements were met.

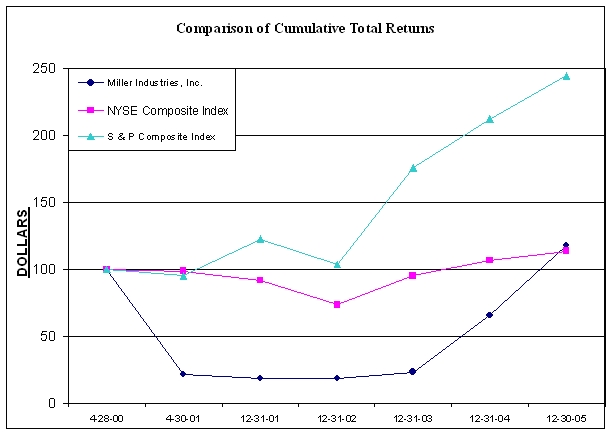

| 4/28/00 | 4/30/01 | 12/31/01 | 12/31/02 | 12/31/03 | 12/31/04 | 12/30/05 | |

| Miller Industries, Inc. | 100 | 22 | 18 | 19 | 23 | 66 | 118 |

| NYSE Composite Index(1) | 100 | 99 | 92 | 73 | 95 | 106 | 114 |

| S&P Construction Index(2) | 100 | 95 | 122 | 103 | 176 | 212 | 244 |

Deadline for Shareholder Proposals for 20072010 Annual Meeting

Any proposal intended to be presented for action at the 2007 Annual Meeting2010 annual meeting of Shareholdersshareholders by any shareholder of the Company must be received by the Secretary of the Company not later than December 31, 200618, 2009 in order for such proposal to be considered for inclusion in the Company’s proxy statement and proxy relating to that meeting. Any such shareholder proposal must meet all the requirements for such inclusion established by the Securities and Exchange Commission in effect at the time.